Cycle Analysis and Indicators

What are Cycles?

A regular cycle is the regular occurrence of an event at specified times and of a specified size. An example of such a cycle is the rotation of the earth around the sun on a regular 365.25-day basis i.e. at -23.5 degree latitude (the Southern Hemisphere) the sun will always be directly overhead (no shadow) at 12h00 noon on the 21st of December. Another regular cycle is the 24-hour rotation of the earth around its own axis.

Mathematically speaking a regular cycle will have a constant size (amplitude) and the time-interval from low to low and from high to high (period) will always be the same. In between highs and lows, the variation of the size with time is described by a sine or cosine (very smooth) curve.

In economic time series, such as the price movement of a share with time, one can hardly hope for such regular cycles. If the cycles were indeed so regular, everybody would have been able to spot them and there would have been no markets for these instruments. Here the movement will be much more erratic i.e. both the amplitude and the period will vary with time.

The purpose of a cycles program, such as Cycle Trends, is to find these irregular or erratic cycles in the history of a financial instrument and to project them forward in time with a sufficient measure of certainty to be useable for profitable trading or investment.

History of Cycle Analysis

Probably the first well-documented use of cycles appeared in the Bible when Joseph, while in jail in Egypt, figured out that the Nile River has a 14-year cycle of floods and droughts. This made him the second most powerful man in the world of his time.

When primitive societies started to change from hunting and gathering to agriculture, around 10 millennia ago, the seasons had to be studied to determine the ideal time for planting. Stonehenge probably served as an early attempt at such a venture, but many such sites existed in the ancient world.

The next big impetus for cycles came after the Industrial Revolution when it was realised that economic prosperity is not a smooth process but moves in cycles. A General Leonard P Ayres expressed it very well when he said:

"Business cycles are as old as the industrial era. Their prosperities have created thousands of fortunes and their depressions have made millions of workers hungry and desperate. They have overturned governments, fomented revolutions, and caused wars. They are our most serious political problem."

The origin of the theory of business cycles may be traced back to a paper by a Swiss historian, JCL de Sismondi, in 1819. After that many economists, such as Juglar, Kitchin, Kondratieff and Jevons became famous for finding specific cycles in business activity.

In 1801, the celebrated astronomer Sir William Herschel, in a paper read before the Royal Society, drew attention to an apparent relationship between sunspot activity and the price of wheat. When sunspots were high, wheat grew abundantly and vice-versa. This proved to be one of the most successful forecasts of the 19th century.

In 1940 ER Dewey set up the Foundation for the Study of Cycles in Pittsburg. Since then this foundation became the leading body of cycle studies in the world. They have identified cycles in thousands of events ranging from geese populations to silt deposits in lakes to long term cycles in the Dow Jones Index and the prices of gold and wheat.

Indicators of Cycle Analysis

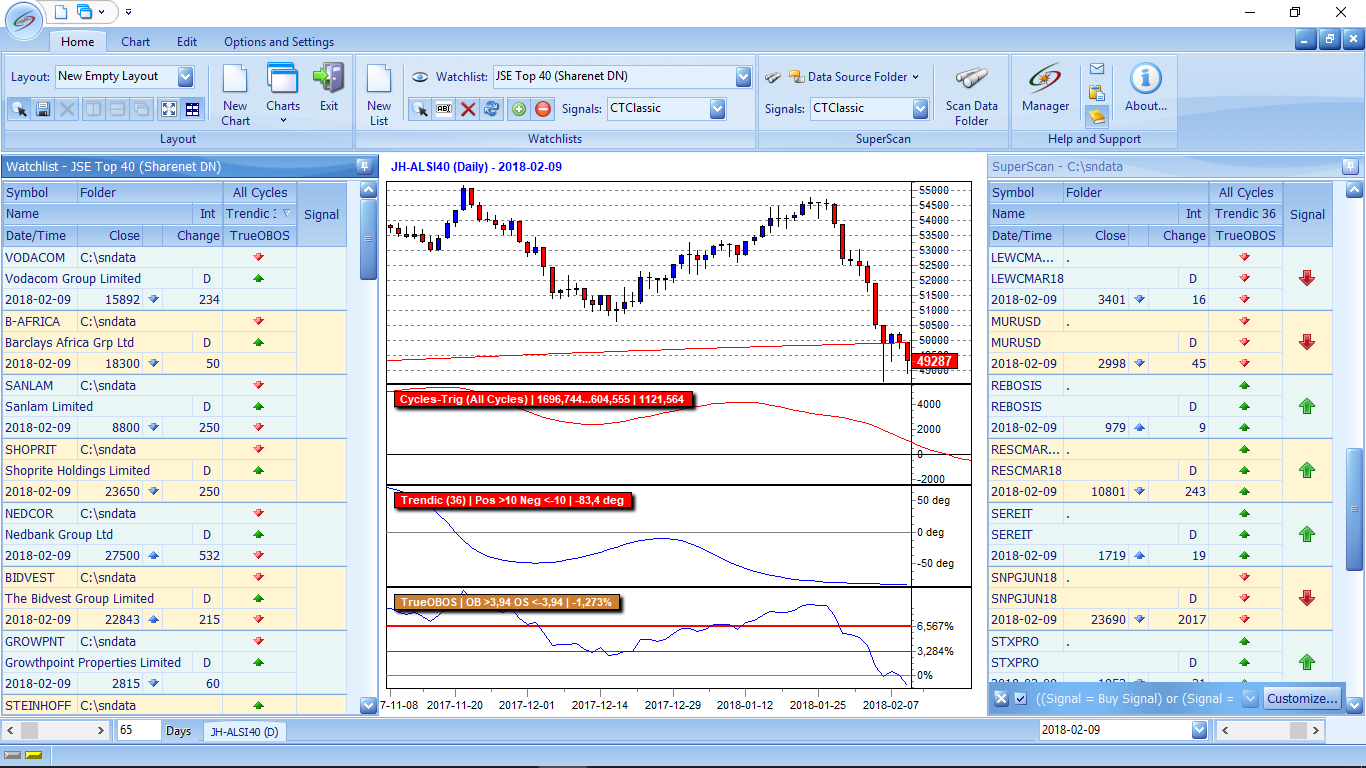

Cycle Trends uses four specialized indicators for performing cycle analysis: Cycles-trig, Cycles-array, Trendic, and TrueOBOS. These indicators are not based on standard methods of technical analysis, but rather on the mathematical/engineering methods of digital signal processing.

These methods can only be applied to a stationary series i.e. a de-trended time series. To de-trend the series a Fourier filter is used (represented by the blue line in the Cycle-Trends price graph window). There are many advantages to the Fourier filter such as that it does not loose end points as a centered moving average filter would do.

The Fourier filter is basically a regression method, meaning that history changes as you move on in time, deleting old data and adding new data. The displayed shape of the blue line on the price graph may therefore change from day to day and this makes it strange for new users. One has to use the go-back facility to evaluate the cycle indicators at a specific point in the history.

To obtain the Cycles-trig indicator cycles of a specific shape viz a sinusoidal shape is fitted via trigonometric regression. The best ones are chosen by the the program and the user can combine them in any way.

To obtain the Cycles-array indicator the cycles may be of any shape from square to triangular to sinusoidal. Once again the best ones are chosen by the program and the user can combine them.

The TrueOBOS measures the deviation from the Fourier trend (the blue line) in a very special and statiscally sound way. Instead of using the standard deviation, which is tied to the Gaussian distribution, it uses the Mean Absolute Percentage Deviation (MAPD) to measure the deviation. The MAPD is non-parametric i.e. distribution free and therefore statistically more sensible. Oversold/overbought levels are described in terms of the MAPD say between one and two.

Trendic has a slightly different flavour. Here the proper Fourier cycles are used. One cannot use Fourier cycles for prediction because the series just ends where it started, it is circular, therefore Trendic is not extended into the future. To enable trendic as a forecasting tool the slope of the series is used. When the slope turns from negative to positive a bottom in the the series was reached and vice versa. In a sense this is not forecasting but confirmation, hence its advocated use.